Africa’s Smartphone Market Shows Resilience Amid Economic Uncertainty

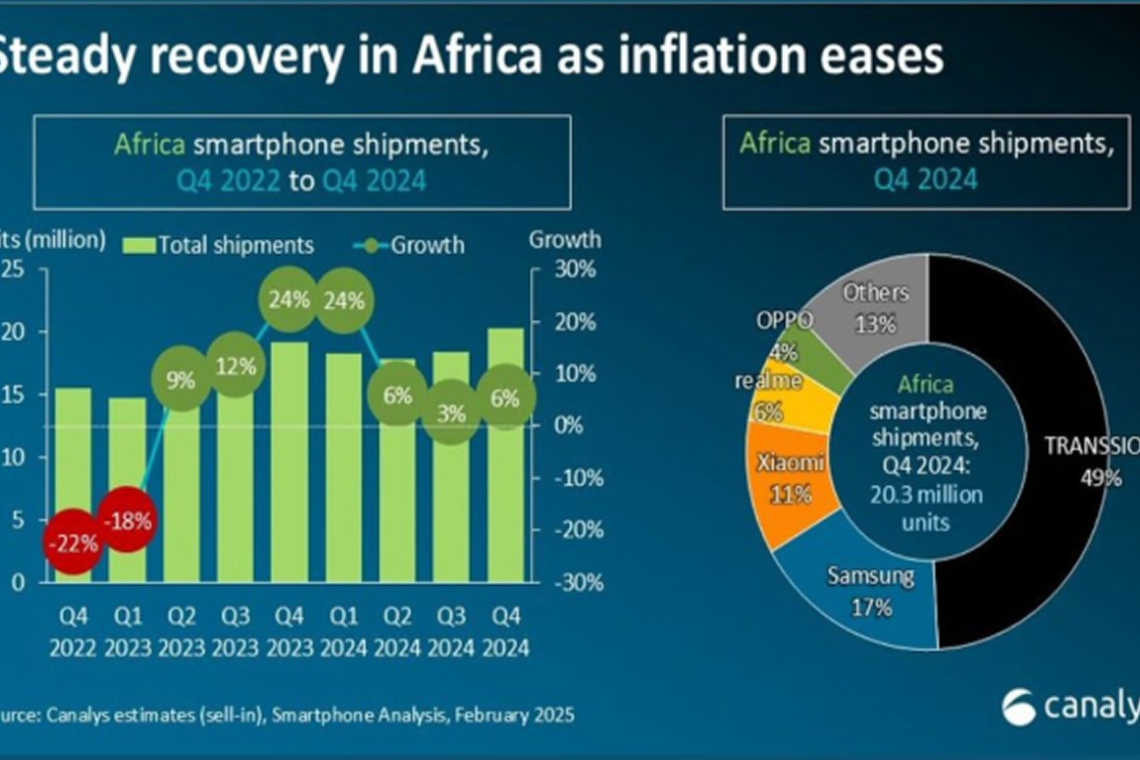

Africa’s smartphone market grew 9% in 2024, but 2025 faces inflation, currency risks, and policy changes, slowing growth to 2%. Recent research from Canalys, now part of Omdia, reveals that Africa’s smartphone shipments grew by 9% year over year in 2024. This growth signals the market’s resilience despite ongoing global economic volatility. The recovery was primarily fueled by easing inflation, which increased consumers' purchasing power, as well as smartphone vendors expanding into emerging markets. Additionally, a replacement cycle followed the peak shipments seen during the COVID-19 pandemic in 2021, when Africa recorded its highest annual smartphone shipments at 90.5 million units.

Looking ahead, Africa remains a promising market with significant long-term potential. However, in 2025, the region will likely face macroeconomic challenges such as persistent inflation, currency depreciation risks, and sluggish economic momentum. Canalys projects a modest 2% growth in Africa’s smartphone market for 2025.

Market Trends: Policy Shifts and Price Pressures Affect Growth

The performance of individual African markets in Q4 2024 varied significantly due to economic policies and shifting consumer trends. In Nigeria, the smartphone market saw a 1% decline, maintaining a 14% regional share. Rising living costs countered the usual boost from the festive season. Additionally, a proposed 100% tariff increase by telecom operators in 2025 could further slow demand as consumers adjust to higher data expenses.

Egypt, on the other hand, continued its growth streak for the fourth consecutive quarter, achieving a 12% increase in smartphone shipments. This growth was attributed to economic stability and new policies supporting local manufacturing. In January 2025, the government imposed an import tax of up to 38.5% on mobile phones to encourage domestic production and regulate imports.

Algeria benefited from post-2020 economic reforms, with its smartphone market growing 11% in Q4 2024. Conversely, Morocco’s market struggled, experiencing a sharp 34% decline. Higher customs duties introduced in early 2024 led to increased prices, reduced consumer spending, and delayed upgrades.

Kenya also faced a downturn, recording a 4% decline in Q4 2024. New regulations introduced in November now require tax compliance verification before devices can connect to local networks, complicating operations for vendors and slowing shipments. South Africa saw a slight 1% dip in Q4, but improved economic conditions, lower interest rates, and rising consumer confidence helped stabilize the market after a significant decline in the previous quarter.

Shifting Consumer Preferences and Vendor Performance

In Q4 2024, there was a 49% year-on-year surge in shipments of smartphones priced under $100, highlighting financial strain on consumers. TRANSSION maintained its leading position with a 49% market share, though its year-on-year growth was a modest 1% in Q4 2024. The company is diversifying into new product categories such as home appliances, though these have yet to contribute significantly to its revenue.

Samsung, on the other hand, saw a 17% decline in shipments but recorded a 9% increase in average selling price (ASP) to $240, the highest among Android brands. The company is focusing on strengthening its presence in the mid-premium segment ($200 to $600), targeting Africa’s growing urban middle class that views smartphones as status symbols.

Xiaomi made significant strides, with a 22% increase in shipments. Its aggressive expansion into West African markets like Cameroon and Ghana, coupled with year-end marketing campaigns such as the ‘Xiaomi Deals Carnival’ in Egypt and the ‘Xiaomi Fans Meetup’ in Nigeria, contributed to this growth. Meanwhile, realme recorded an impressive 70% year-on-year growth in Q4 2024, largely due to its expansion in North and East Africa and the success of its Note series.

OPPO also strengthened its foothold in the African market by ramping up investments in local production, particularly in Egypt and Turkey throughout 2024, showcasing its commitment to long-term growth in the region.

2025 Outlook: Modest Growth Amid Economic Complexities

Canalys forecasts a 2% growth in Africa’s smartphone market for 2025 as the region navigates economic challenges. Despite ongoing inflationary pressures, the African Development Bank predicts a decline in the continent’s average inflation rate from 18.6% in 2024 to 12.6% in 2025. Ensuring affordability for mass-market consumers remains central to competition, with vendors and retailers increasingly leveraging device financing to make smartphones more accessible.

The dominance of open-market channels and budget-friendly smartphones is expected to persist in the long run. However, Africa presents one of the most complex business landscapes globally, with risks such as currency fluctuations, shifting tax policies, and geopolitical uncertainties requiring strong operational adaptability.

Notably, the resilient business models developed by smartphone vendors in Africa—ranging from mitigating sudden risks to aligning closely with mass-market needs—could serve as a blueprint for expansion into other emerging markets